The U.S. July non-farm employment report showed a weak performance, increasing the risk of a hard landing for the U.S. economy and triggering a large-scale risk-aversion sentiment. The number of non-farm jobs in the U.S. in July fell sharply from the previous value of 179,000 to 114,000, significantly below the expected 175,000. The unemployment rate rose to 4.3%, the highest level in three years, and triggered the recession indicator with a 100% accuracy rate—Sam's Rule.

Following the data release, U.S. stock futures extended their losses, and U.S. Treasury yields plummeted. The yield on the 2-year U.S. Treasury note fell as much as 26 basis points to its lowest level since May 12, 2023, with yields on all maturities of U.S. Treasuries sliding by at least 12 basis points. Eurozone bond and UK gilt yields followed the U.S. Treasury decline. The U.S. dollar index dived 1%, the yen rose 2% to break 147, and the offshore renminbi surged by over 1,000 points to a new high since January, with gold rising nearly 1.3% during the day.

The market now expects that the Federal Reserve will have the equivalent of four 25-basis-point rate cuts in the remaining three meetings of the year, totaling a digested magnitude of about 108 basis points, implying that one of them is expected to be 50 basis points. This assessment has extended the rally in U.S. Treasuries to a seventh day. The market has begun to believe that the Fed's rate cut actions are too late.

Calls for U.S. rate cuts are echoing, with U.S. Senate Democratic member Elizabeth Warren stating that Federal Reserve Chairman Jerome Powell made a "serious mistake" by not cutting rates and that Powell needs to cut rates now, not wait another six weeks. Wall Street giants have also adjusted their rate cut expectations. Citigroup expects the Fed to cut rates by 50 basis points in September and November, and by 25 basis points at the December meeting. Goldman Sachs expects the Fed to cut rates by 75 basis points this year, with three cuts, up from a previous expectation of 50 basis points. JPMorgan Chase expects the Fed to cut rates by 50 basis points in September and November.

Advertisement

However, some economists hold a different view, arguing that if the Fed cuts rates by 50 basis points, it will cause panic, and the market's expectation of a significant rate cut is too premature. The U.S. employment data is not severe enough to require emergency action by the Fed.

Two Federal Reserve members who have a vote this year spoke, with Chicago Fed President Goolsbee warning against overreacting to a single month's data, stating that more data can be obtained before the September meeting. Richmond Fed President Barkin acknowledged that once the U.S. economy softens rapidly, it usually triggers significant rate cuts.

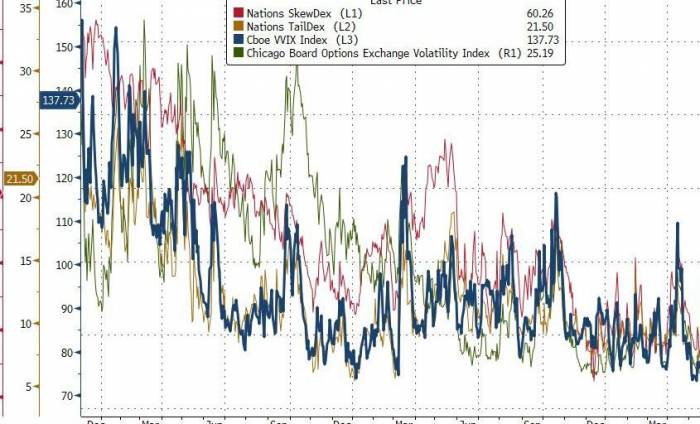

Recession fears intensify as the Nasdaq falls 2.38% into the correction range, with Intel plummeting 26%, and the VIX volatility index rising by more than 59% during the session.

On Friday, August 2, U.S. recession alarms triggered market panic selling, with U.S. stock indices opening significantly lower and suffering substantial declines during the session.

After the release of the shocking non-farm data in the U.S. stock market's early morning, major indices hit new daily lows, with the technology stock-heavy Nasdaq falling nearly 3.6% at its lowest point by the end of the day; the S&P 500 index fell nearly 2.7% at its lowest; the Dow Jones index, closely related to the economic cycle, fell nearly 2.5% or 989 points at its lowest; and the Russell small-cap index fell nearly 4.4% at its lowest.

As of the close:The S&P 500 index closed down 100.12 points, or 1.84%, at 5,346.56, approaching the closing level of 5,291.34 on June 4th, with a weekly decline of 2.06%, following two previous weeks of declines of 1.97% and 0.83%, respectively. The Dow Jones Industrial Average closed down 610.71 points, or 1.51%, at 39,737.26, with a weekly loss of 2.10%, ending a four-week winning streak. The Nasdaq Composite fell 417.98 points, entering a technical correction territory, down 2.43%, at 16,776.16, with a weekly loss of 3.35%, continuing the performance of declines of 3.65% and 2.08% in the previous two weeks.

The Nasdaq 100 fell 2.38%; the Nasdaq Technology-Weighted Index (NDXTMC), which measures the performance of technology components in the Nasdaq 100, fell 2.60%; the Russell 2000 index closed down 3.52%, with a weekly loss of 6.67%; the Volatility Index (VIX) closed up 26.04%, at 23.43, rising to 29.66 at 23:27 Beijing time, approaching the psychological threshold of 30 and the March 13, 2023, peak of 30.81, with a weekly increase of 42.95%.

The Philadelphia Semiconductor Index closed down 5.18%, entering a bear market, with a 21.96% correction from its historical closing high on July 10th, and a weekly loss of 9.71%. The KBW Bank Index on the Philadelphia Stock Exchange closed down 4.32%, marking the largest single-day drop since May 2023, with a weekly loss of 7.87%. The Dow Jones KBW Regional Banking Index closed down 3.34%, with a weekly loss of 9.09%.

The VIX index reached a high of 29.66 on Friday, the highest level since October 2022. The VVIX index broke through the key panic level of 100 this week, reaching a high of 162.68 on Friday, the highest level since March 2022.

Among the 11 sectors of the S&P 500, the consumer discretionary sector closed down 4.61% on the non-farm payroll day, with financial, energy, and industrial sectors falling up to 2.42%, the information technology/technology sector down 1.99%, the telecommunications sector down 1.92%, and the materials sector down 1.89%. In contrast, the real estate sector rose 0.09%, the utilities sector rose 0.14%, and the consumer staples sector rose 0.86%.

For the week, the consumer discretionary sector accumulated a decline of 4.28%, the technology sector fell 4.03%, the energy sector fell 3.74%, the financial sector fell 3.02%, the industrial sector fell 2.79%, the materials sector fell 1.39%, the healthcare sector rose 0.65%, the consumer staples sector rose 1.16%, the telecommunications sector rose 1.26%, the real estate sector rose 3.10%, and the utilities sector rose 4.29%.

In terms of investment research strategy:

Bank of America strategist Michael Hartnett suggests that investors should sell stocks when the Federal Reserve first cuts interest rates due to the increased likelihood of a more severe recession in the United States.

Goldman Sachs' prime brokerage data as of August 2nd shows that hedge funds have reduced their global equity holdings for the third consecutive week, with sales of North American stocks exceeding purchases in other regions. Emerging markets in Asia were the most net-purchased region. Chinese stocks saw net purchases for the first time in three weeks, with the largest net purchase size in two months.

Among the "Tech Seven Sisters," all except Apple fell, with Amazon, Tesla, and Alphabet Inc. experiencing four consecutive weeks of declines. Apple closed up 0.69%, with a weekly gain of 0.87%, after two previous weeks of declines of 2.7% and 2.83%, respectively. The company has exceeded revenue and profit expectations for six consecutive quarters, with the Greater China region being the only one to decline; Nvidia closed down 1.78%, with a weekly loss of 5.12%, after two previous weeks of declines of 8.75% and 4.13%, respectively. The company faces an antitrust investigation by the U.S. Department of Justice due to complaints from competitors; Tesla closed down 4.24%, with a weekly loss of 5.52%, after three previous weeks of declines of 1.31%, 3.64%, and 8.11%, respectively.Amazon fell 8.78%, down 8% for the week, following declines of 2.75%, 5.84%, and 0.34% in the previous three weeks, respectively. The Q3 guidance was lackluster, and under the pressure of AI investment, cloud demand is flashing a red light. TD Cowen has downgraded Amazon's target price from $245 to $230. "Metaverse" Meta fell 1.93%, up 4.82% for the week, after declines of 7.6%, 4.43%, and 2.33% in the previous three weeks; Microsoft fell 2.07%, down 3.95% for the week, after declines of 3%, 3.62%, and 2.71% in the previous three weeks; Google A fell 2.4%, down 0.2% for the week, after declines of 2.9%, 4%, and 6% in the previous three weeks.

Reports indicate that hedge fund Elliott, in a letter to investors, stated that large tech stocks, especially NVIDIA, are in a bubble. It is doubtful whether large tech companies will continue to buy NVIDIA's graphics processing units (GPUs) in large quantities, and artificial intelligence is "overhyped, with many applications not yet ready for their prime time."

Currently, the market value of the stocks of the seven tech giants has fallen by approximately $2.3 trillion from their historical peak.

Chip stocks have almost completely collapsed. The Philadelphia Semiconductor Index fell 5.18% and accumulated a weekly decline of 9.7%; the industry ETF SOXX fell 5.32%; NVIDIA's double leveraged ETF fell 4.14%.

TSMC's US stocks fell 5.26%, Arm Holdings fell 6.63%, Qualcomm fell 2.86%, Broadcom fell 2.18%, AMD fell 0.03%, KLA fell 7.93%, ON Semiconductor fell 5.49%, Micron Technology fell 8.68%, dropping 9.8% at one point to reach the worst intraday performance in the last four years. Applied Materials fell 7.38%, and ASML ADR fell 8.41%.

It is worth mentioning that Intel's earnings disappointed the market, closing down more than 26%, marking the largest decline since at least 1982, and performing the worst among the 30 components of the Philadelphia Semiconductor. HSBC downgraded Intel to a "reduce" rating with a target price of $19.80, Raymond James and Benchmark downgraded Intel from "buy" to "hold," and S&P placed Intel on a credit negative watch list.

AI concept stocks collectively fell. Serve Robotics, an AI robot delivery company with NVIDIA holdings, fell 15.24%, Dell Technologies fell more than 5.6%, C3.ai fell about 5.4%, SoundHound AI, an AI voice company with NVIDIA holdings, fell 0.86%, BigBear.ai fell 4.29%, Snowflake fell 3.57%, Super Micro Computer fell 7.08%, CrowdStrike fell 2.82%, Palantir fell 5.14%, Oracle fell 3.08%, while BullFrog AI rose 5.54%.

Most Chinese concept stocks fell. The NASDAQ Golden Dragon China Index closed down 1.84% and accumulated a weekly decline of 5.9%. Among ETFs, the China Internet ETF (KWEB) closed down 1.16%, accumulating a weekly decline of 3.14% for three consecutive weeks, and the China Technology Index ETF (CQQQ) closed down 0.8%, accumulating a weekly decline of 0.76%.

Among popular Chinese concept stocks, "education concept stocks" TAL Education fell 6.72%, New Oriental fell 2.93%, among the "new force in car manufacturing," NIO fell 0.25%, XPeng fell 0.92%, Li Auto fell 0.88%, Zeekr fell 0.52%; JD.com fell 0.32%, Pinduoduo fell 0.32%, Tencent Holdings (ADR) fell 0.82%, Baidu fell 2.23%, Alibaba fell 0.68%, NetEase fell 1.24%, while Bilibili rose 1.77%.

Stocks most affected by the economic recession also fell, with US bank stocks generally closing down. JPMorgan Chase fell 4.24%, Wells Fargo fell 6.36%, Citigroup fell 7.14%. Morgan Stanley closed down 5.81%.It is noteworthy that Morgan Stanley was downgraded to a "sell" rating for the first time in 2024 by analysts. Wells Fargo analyst Mike Mayo downgraded Morgan Stanley to an underweight rating (previously at equal-weight), citing that certain business pressures have led to its valuation being high within the industry. The analyst believes that Morgan Stanley's wealth management division is facing numerous headwinds.

Among other stocks with significant changes due to earnings reports:

Chevron fell 2.7%, with Q2 net profit down 26% year-over-year, missing expectations. RBC lowered its target price for Chevron from $190 to $180.

Exxon Mobil opened high but closed lower, almost recovering a 1.3% loss at the end of the day. Q2 profits exceeded expectations, and the company is expected to repurchase over $19 billion worth of shares this year. After acquiring Pioneer Natural Resources in early May, the company's oil and gas production reached an all-time high. Exxon Mobil's CEO stated seeing "very strong" oil demand. Global oil supply maintains healthy crude oil prices.

"Retail investor favorite" AMC Entertainment Holdings closed down 3.52%, with Q2 revenue in line with expectations, and adjusted loss per share at $0.43, which was better than expected, leading to a 3.21% increase in after-hours trading on U.S. markets.

Coinbase closed down 3.86%, with Q2 revenue up 105% year-over-year but down 11% quarter-over-quarter. Q2 net profit was $36 million, down 97% quarter-over-quarter, compared to a net loss of $97 million in the same period last year. Jefferies raised its target price for Coinbase from $215 to $245 and maintained a "hold" rating. Bank of America Securities lowered its price target for Coinbase from $263 to $246.

Social media stock Snap closed down 26.93%, with Q2 revenue and Q3 outlook both falling short of market expectations. HSBC downgraded its rating for Snap to hold, with a target price of $11. TD Cowen lowered its target price for Snap from $14 to $11.

Argentinian e-commerce company Mercadolibre (MELI) closed up 10.59% at $1776.14, with a market cap surpassing $90 billion, overtaking Brazilian oil company Petrobras to become the most valuable company in Latin America.

Cryptocurrency and blockchain-related stocks generally fell. Bit Digital closed down 12.87%, with popular brokerages like Robinhood, Bitdeer, and Bitfarms falling up to 11.66%, Riot Platforms down over 8%, "Bitcoin whale" MicroStrategy (MSTR) down over 4.2%, Ethereum ETF (QETH) down 3.89%, cryptocurrency exchange Coinbase down 3.86%, while the double inverse Bitcoin ETF closed up 2.47%, and Ideanomics (IDEX) surged 26.95%.

Gold and silver mining stocks generally closed lower. Avino Silver fell 8.82%, Cordoba Minerals fell 8.33%, Hecla Mining fell 7.32%, Pan American Silver fell over 5%, Harmony Gold fell approximately 3.9%, Gold Fields fell about 3.2%, and gold mining ETF (GDX) fell over 2.1%.Poor US non-farm employment data sparked recession fears, with investors significantly increasing bets on rate cuts by the Federal Reserve, the European Central Bank, and the Bank of England within the year. European stocks fell sharply for two consecutive days, with the technology sector plunging more than 6% during Friday's trading. The pan-European Stoxx 600 index and national stock indexes for Germany and Italy both fell over 2%, with the Italian bank index falling more than 8.6% this week.

The pan-European Stoxx 600 index closed down 2.73% at 497.85 points. Since reaching a historical closing high of 524.71 points on May 15, it has corrected by nearly 5.12%, with a cumulative decline of 3.92% in the last two trading days. It has recently broken below the 50-day and 100-day moving averages, with a weekly decline of 2.92%.

The Eurozone STOXX 50 index closed down 2.67% at 4638.70 points, breaking through the 200-day moving average (this technical indicator temporarily reported at 4742.48 points), approaching the closing position of 4638.60 points on February 1 and 4403.08 points on January 17, with a weekly decline of 4.60%.

In terms of sectors for the week, the STOXX 600 bank index fell by 7.78%, the technology index fell by 6.27%, and the real estate index rose by 2.70%.

The German DAX 30 index closed down 2.33%, with a correction of over 6.40% from the historical closing high of 18869.36 points set on May 15, with a weekly decline of 4.11%. The French CAC 40 index closed down 1.61%, with a cumulative correction of over 11.99% since reaching a historical closing high of 8239.99 points on May 15, with a weekly decline of 3.54%.

The Italian FTSE MIB index closed down 2.55%, with a weekly decline of 5.30%. The UK FTSE 100 index closed down 1.31%, with a weekly decline of 1.34%. The Dutch AEX index closed down 3.11%, with a weekly decline of 3.06%. The Spanish IBEX 35 index closed down 1.67%, with a weekly decline of 4.42%.

Among the more volatile stocks:

The European technology sector suffered a significant drop, with ASM International closing down 12.63%, ASML Holdings down 11.18%, with a correction of over 25% from its historical closing high, and BE Semiconductor Industries down 9.34%.

On "Non-Farm Day," the two-year US Treasury yield plummeted by more than 26 basis points, with US Treasuries having seven consecutive gains, becoming the preferred safe-haven for a "hard landing" in the United States.

At the end of the day, the two-year US Treasury yield, which is more sensitive to monetary policy, fell by 26.64 basis points to 3.8798%. After the non-farm data was announced, it fell by 26 basis points, dropping from 4.1% to 3.8408%, the lowest level since May 12, 2023, with a cumulative decline of 50.35 basis points for the week.The 10-year benchmark U.S. Treasury yield fell by 18.56 basis points to 3.7904%, plunging from around 3.93% to below 3.8% when the U.S. non-farm employment report was released at 20:30 Beijing time, and refreshed its daily low to 3.7847% at 03:51 (close to the U.S. stock market close), approaching the bottom of 3.7815% on December 27, 2023, staying in a downward trend throughout the day, with a cumulative decline of 40.35 basis points for the week.

Analysts say that this week, U.S. Treasury yields fell sharply across the board, with the two-year Treasury yield falling nearly 30 basis points on Friday alone, and a significant drop of 50 basis points for the week. Friday saw the largest decline in the two-year yield since December 2023 (when Powell shifted his stance) and the largest weekly drop since March 2023 (when SVB collapsed).

Eurozone bonds and UK gilts followed the U.S. Treasury rally. The 10-year benchmark German bund yield fell by 7.0 basis points to 2.174%, with a cumulative decline of 23.4 basis points for the week. The two-year German bund yield fell by 10.2 basis points to 2.352%, with a cumulative decline of 27.0 basis points for the week.

The French 10-year government bond yield fell by 2.6 basis points, with a cumulative decline of 14.8 basis points for the week. The Italian 10-year government bond yield fell by 1.4 basis points, with a cumulative decline of 13.3 basis points for the week. The Spanish 10-year government bond yield fell by 3.0 basis points, with a cumulative decline of 17.2 basis points for the week. The Greek 10-year government bond yield fell by 0.6 basis points, with a cumulative decline of 13.4 basis points for the week. The two-year UK gilt yield fell by 11.8 basis points, with a cumulative decline of 31.5 basis points for the week. The UK 10-year government bond yield fell by 5.4 basis points, with a cumulative decline of 27.2 basis points for the week.

The risk of a hard landing for the U.S. economy is increasing, and investors are bearish on the outlook for oil demand, with U.S. oil falling by more than 3% to a two-month low.

WTI September crude oil futures closed down $2.79, a drop of nearly 3.66%, at $73.52 a barrel. The week saw a cumulative decline of 4.72%. Brent October crude oil futures closed down $2.71, a drop of nearly 3.41%, at $76.81 a barrel. The week saw a cumulative decline of 5.32%, with Brent crude oil once hitting a six-month intraday low.

Both U.S. and Brent crude oil rose by nearly 1.3% and 1.2% respectively in the early European stock market, breaking through the round numbers of $77 and $80, but both then fell sharply and turned negative, hitting daily lows around 2:00 a.m. Beijing time, with U.S. and Brent crude oil falling by nearly 4.4% and 3.9% respectively, breaking through $73 and approaching $76.

Analysts say that despite escalating tensions in the Middle East, U.S. oil still fell by more than 4.7% this week, as weak economic growth in major economies is likely to suppress oil demand, overshadowing supply concerns triggered by tensions in the Middle East. Manufacturing data from the world's largest oil importer, as well as most Asian and European and American countries, has weakened, increasing the risk of a global economic slowdown and putting pressure on oil consumption. Asia's crude oil imports in July fell to the lowest level in two years. At the same time, the OPEC+ meeting held on Thursday maintained the oil production policy unchanged and plans to gradually cancel production cuts starting in October.

U.S. September natural gas futures closed down 0.05%, at $1.9670 per million British thermal units. The week saw a cumulative decline of 1.94%. Investors are focusing on supply risks, driving European natural gas futures to rise by more than 14% this week, the largest single-week increase since April. The European benchmark TTF Dutch natural gas futures rose by 0.27%, at €37.000 per megawatt-hour, with a cumulative increase of 14.02% for the week. ICE UK natural gas futures rose by 0.81%, at 90.900 pence per therm, with a cumulative increase of 13.23% for the week.

On "Non-Farm Day," the U.S. dollar fell by more than 1%, the offshore yuan rose by more than a thousand points during the session to a six-month high, Bitcoin fell, and the yen rose by more than 4.7% this week, approaching 146.The US Dollar Index (DXY), which measures the greenback against a basket of six major currencies, fell by 1.15% to 103.221 points, approaching the March 14 low of 102.736 points. The index recorded a weekly decline of 1.05%, with a trading range of 104.799-103.125 points, breaking out of the narrow fluctuation seen earlier in the week following the release of the US non-farm payrolls report.

The Bloomberg Dollar Index dropped by 0.69% to 1249.24 points, with a weekly decline of 0.62%, and a trading range of 1263.55-1247.50 points.

Most non-US currencies rose. The euro gained 1.11% against the dollar, trading at 1.0911, with a weekly increase of 0.50%; the British pound rose by 0.52% against the dollar, trading at 1.2805, with a weekly decrease of 0.48%; the dollar fell by 1.81% against the Swiss franc, trading at 0.8577, with a weekly drop of 2.93%, showing a smooth decline from Tuesday to Friday, with the downward trend intensifying after the release of the non-farm payrolls report.

The offshore renminbi (CNH) ended the day up by 873 pips against the dollar, trading at 7.1638 yuan, with an intraday high of over 1000 pips reaching 7.1437 yuan, a daily increase of about 1.4%, marking a new high since January.

Among Asian currencies, the dollar fell by 1.89% against the yen, trading at 146.53 yen, with a weekly drop of 4.75%, and a trading range of 155.22-146.42 yen, showing a stable trend on Monday and a smooth downward trend from Tuesday onwards. The euro fell by 0.81% against the yen, trading at 159.89 yen, with a weekly drop of 4.21%; the British pound fell by 1.47% against the yen, trading at 187.646 yen, with a weekly drop of 5.09%.

Geopolitical conflicts in the Middle East escalated, leading to a significant drop in Israeli assets. The Israeli shekel fell for the fifth consecutive day, marking the longest losing streak since October 2023.

Most mainstream cryptocurrencies declined. Bitcoin, the largest by market capitalization, saw its losses widen to over 5% at the end of the day, falling below $62,000, after rising close to $66,000 following the US non-farm payrolls report. The cryptocurrency recorded a weekly decline of 8.48%, having broken through $70,000 at the beginning of the week.

Ethereum, the second-largest cryptocurrency, also saw its losses widen, falling by over 6% and breaking below $3,000 at the end of the day, after reaching $3,200 following the US non-farm payrolls report. It also recorded a weekly decline of 8%, having broken through $3,400 at the beginning of the week.

According to data from Coinglass, nearly 90,000 people liquidated their positions in the cryptocurrency market within the past 24 hours, with liquidated amounts reaching $255 million.

The softening of the US dollar boosted gold prices, which surged by over 1%, but later turned lower due to profit-taking. However, supported by tensions in the Middle East and expectations of interest rate cuts, gold still recorded a weekly gain of over 2.3%.Poor non-farm data has increased expectations for interest rate cuts, which has pressured the US dollar and US Treasury yields lower, causing gold prices to surge during trading but then retreat at the close. The COMEX December gold futures closed up 0.21% at $2,486.10 per ounce, with a weekly gain of 2.11%. The COMEX September silver futures closed up 0.07%, with a weekly gain of 2.23%. Spot silver closed up 0.13% at $28.5597, with a weekly gain of 2.12%.

Spot gold and silver initially rose before the opening of US stocks, with spot gold hitting a daily high of nearly 1.3%, approaching $2,480, close to the historical high of $2,483.60 set on July 17, after the US non-farm employment data was released at 8:30 pm Beijing time. Spot silver rose nearly 2.5%, breaking through the $29 mark. However, during the early morning session of US stocks, both gold and silver prices plummeted, with spot gold falling over 1.4% to approach $2,410, retreating more than $66 from its daily high, and spot silver, with its industrial metal attributes, falling over 2% to break through the $28 mark.

Most of the basic industrial metals in London closed lower. The economic indicator "Dr. Copper" closed up $3, at $9,056 per ton, with a weekly decline of over 0.60%. London aluminum fell over 1.39%, at $2,264 per ton. London zinc fell over 1.99%, at $2,653 per ton. London lead fell 1.89%, at $2,023 per ton, with a weekly decline of over 2.17%. London nickel closed down $9, at $16,273 per ton, with a weekly gain of over 3.03%. London tin closed up $294, up over 0.98%, at $30,188 per ton, with a weekly gain of over 2.08%.