This week has been a week of divergence followed by consensus in the A-share market. On Monday, there was divergence, on Tuesday, there was a consensus to counter-encircle, and on Wednesday, there was a sharp drop with a record volume, marking the first major divergence and turnover since the rebound of the A-share market. After this divergence, the market's understanding of AI's main theme has become clearer. On Thursday, after the market opened, funds quickly rushed towards AI, especially domestic computing power. The revival of the AI main theme drove a significant rise in the A-share market on Thursday.

As we mentioned yesterday, bull markets often experience sharp declines, and a major trend will have multiple major divergences. Before the market truly peaks, after each divergence, consensus will be reformed, and the main theme will be held more tightly. The result of divergence and reformation of consensus is a wave pattern of a wave initiation, a second wave correction, and a third wave main lift. Today's trend in the A-share market is a verification of yesterday's view. Divergence has made the market hold AI more tightly. Today, domestic computing power directly dominated the market. The hydrogen energy that was hot yesterday directly cooled down to make way for computing power. Except for Seres, all the top ten trading volumes were AI stocks. In fact, the fundamentals of new energy have improved recently, but AI has just started, and all the funds are focused on AI, suppressing the voice of new energy.

Advertisement

Today, there is a new trend in the AI market, which is high to low, small to large, and thematic to core. Although the market was also speculating on AI before, many were thematic stocks, such as media. But in the past two days, it has started to focus on core computing power stocks such as Sugon, Inspur Information, and Unisplendour. Today, before the surge, Inspur Information and Unisplendour were relatively low compared to Sugon.

The scale of quantitative DMA products needs to be gradually phased out. The era of small and micro-cap stock style dominating the market has become a thing of the past. It is expected that it will become increasingly difficult to speculate on thematic stocks in the future. Incremental funds have become foreign capital, public and private funds, and other institutions. Core assets are about to take the stage, and I would like to remind everyone to stay away from speculation.

AI computing power

In the past two days, we have been sharing core information about domestic computing power with you. If you are interested, you can review it. Today, there is some incremental information for the surge in computing power:

It is reported that two major domestic manufacturers placed orders for H20 yesterday, with a relatively large volume. The annual shipment of H20 is expected to be in the hundreds of thousands of pieces, and the previous market expectation should be around 300,000 pieces. The news is that Nvidia's cut version of the chip, H20, has been confirmed to enter China. This news is mainly good for Inspur Information, which was not very good before because it was relatively dependent on Nvidia chips.

Logically, this information is bearish for domestic computing power, such as the Zhongke system and Huawei system. However, today, Sugon, Digital China, and others are still very strong. The weak is not weak, which is strong, indicating that the market recognizes the logic of domestic computing power. We also analyzed yesterday that AI has become a key to the competition among major countries, and the term "sovereign AI" explains the political position of AI.

In addition, Dell released its Q4 performance, achieving a revenue of 22.32 billion US dollars, flat on a quarter-on-quarter basis, and -11% year-on-year. Among them, server revenue was 4.86 billion US dollars, an increase of 4% quarter-on-quarter. Dell delivered 800 million US dollars in AI servers this quarter, and the backlog of orders doubled quarter-on-quarter to 2.9 billion US dollars. The delivery period of H100 has improved but is still in short supply, and customers are very interested in H200 and MI300X. Dell's guidance for FY25Q1 AI server shipments exceeds FY24Q4. Stimulated by this, Dell's stock price soared by 18% after the market.Charging Piles

Xinhua News Agency reports that on the afternoon of February 29th, the Political Bureau of the CPC Central Committee held its twelfth collective study session on new energy technology and China's energy security. The meeting pointed out the need to adapt to the transformation of energy and further build a good new energy infrastructure network, promote the intelligent transformation of power grid infrastructure and the construction of smart microgrids, and enhance the power grid's ability to accept, allocate, and regulate clean energy. Accelerate the construction of a charging infrastructure network system to support the rapid development of new energy vehicles.

According to the Charging Alliance forecast, in 2024, the domestic public direct current piles are expected to increase by 526,000 (calculated by gunheads), a year-on-year increase of 25.2%. Considering the development of fast charging and the expected further increase in single-gun power, we estimate that the growth in terms of additional power will be at least over 30%. Looking at the sales guidance for charging piles from core pile companies in 2024, the growth rate is generally between 30-100%, reflecting the industry's continued confidence in domestic demand for charging piles in 2024. With the industry's high prosperity, the performance of the industry chain is expected to be accelerated.

Stimulated by this, today's A-share charging pile sector saw a significant increase, with stocks such as Inkeri, Oulu Tong, and Green Energy Hui Charging hitting the daily limit.

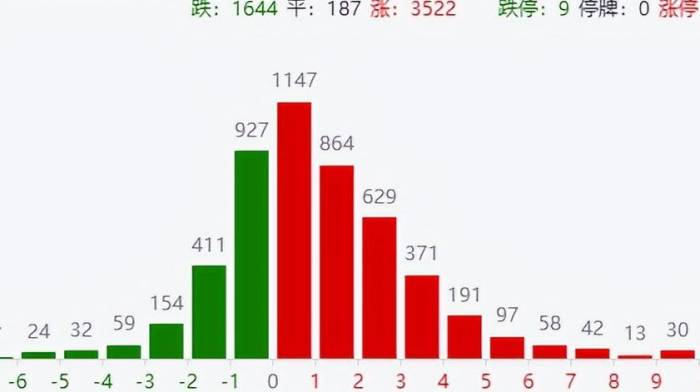

Finally, looking at the market, as of the close, the Shanghai Composite Index rose by 0.39%, and the ChiNext Index rose by 0.94%, recovering to 1,800 points, both setting new recent highs. The Hang Seng Index in Hong Kong rose by 0.47%, and the Hang Seng Technology Index rose by 1.66%. Today, the turnover of A-shares in both markets slightly increased to 1.05 trillion, with more than 3,500 stocks rising. After the explosive volume on Wednesday reaching 1.3 trillion, A-shares have continued to rise for two days. What does the explosive volume at the bottom indicate? However, after a significant purchase yesterday, foreign capital sold a net of 5.333 billion today, possibly fearing the uncertainty of the Two Sessions next week and cashing in early.

Looking at the industry, computer, electronics, communication, home appliances, and media industries led the gains, while beauty care, agriculture, transportation, real estate, and public utilities industries led the declines.

Today, the turnover of the four major TMT industries, electronics, computer, communication, and media, was 404 billion, accounting for 40% of the total turnover of both markets. Drawing on last year's experience, when the turnover of electronics or computers exceeds 200 billion, and the TMT transaction ratio exceeds 45%, it is basically a sign of short-term overheating. Last year, we accurately warned of risks at the peak of the AI market.Just saw a news report that four China A50 ETFs have raised more than the 2 billion cap in their initial offerings, indicating that the public offering market is also warming up, and the public funds are coming. Additionally, the yield on government bonds has surged across the board, while government bond futures have plummeted. Previously, we saw a bull market in both stocks and bonds, but today the bond market has taken a significant hit, possibly due to the strong stock market causing a seesaw effect. Wealth management funds hold a substantial amount of savings, and if they were to enter the stock market, that would be quite remarkable. Of course, this would depend on how the economic recovery progresses. Today's official manufacturing PMI was in line with expectations, and the Caixin manufacturing PMI slightly exceeded expectations. The most critical factor to watch will be the tone set at the Two Sessions next week.

In fact, both the photovoltaic and lithium battery sectors have seen fundamental improvements, but the AI sector has been too dominant, causing new energy to be suppressed. From a rotation perspective, new energy and even consumer goods are good choices.

Risk warning:

The stock market carries risks, and investment should be approached with caution. This article does not constitute investment advice, and readers should think independently.