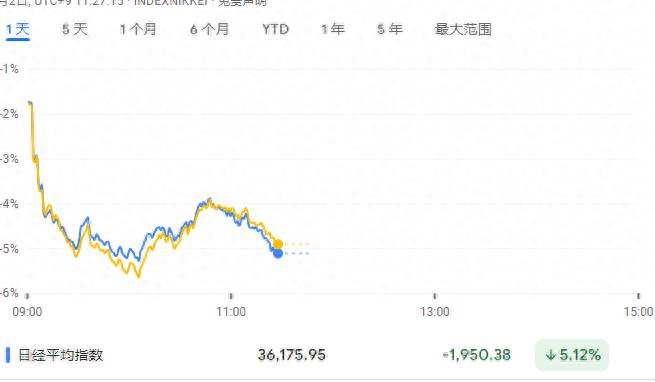

Japanese stocks and currency have been on a "seesaw" trend, with the rapid appreciation of the yen inflicting a heavy blow on Japanese stocks, sparking market concerns. Yesterday, the Topix index recorded its largest single-day drop since April 2020, and today's opening saw Japanese stocks continue to plummet, with both the Nikkei 225 and the Topix index falling by about 5%. On one hand, the significant appreciation of the yen has impacted export companies, while on the other, the Bank of Japan's interest rate hike has weighed on real estate stocks.

The Bank of Japan's measures to "stabilize the yen" have led to a weakening stock market, presenting policymakers with a dilemma: whether to continue raising interest rates to strengthen the yen and curb inflation, or to maintain a loose policy to support economic growth and the stock market.

Tetsuo Seshimo, a portfolio manager at Saison Asset Management, pointed out:

The Bank of Japan's interest rate hike has raised two concerns: one is the adverse impact of the strong yen on export companies, and the other is whether the economy can withstand it, with many unknown factors.

Advertisement

Bank of Japan Governor Haruhiko Kuroda's speech at a press conference on Wednesday further reinforced market expectations that interest rates will continue to rise. Tomoichiro Kubota, a senior market analyst at Matsui Securities, said:

Governor Kuroda's demeanor at the press conference on Wednesday was a stark contrast to his previous stance, taking a very hawkish attitude, and the market's previous assumption that "Japanese interest rates will not rise, and the yen will not appreciate" has changed.

Is the yen carry trade a "structural shift" or a "tactical adjustment"?

Another major focus of market attention is whether the recent unwinding of yen carry trades is a structural shift (i.e., a large-scale unwinding of carry trades) or merely a tactical adjustment (if the stock market crashes, the Bank of Japan will be forced to abandon interest rate hikes).

Bloomberg analyst Simon White pointed out that Japan remains one of the underestimated global macro risks. Japan's vast overseas assets have created a huge structural short yen position, which could drive a significant appreciation of the yen. This could not only put downward pressure on global assets but also disrupt the Japanese economy, ultimately leading to a reversal in the pace of monetary policy tightening and triggering a long-term inflation threat.The closing of yen short positions may occur through three main avenues, each of which could trigger a self-reinforcing significant appreciation of the yen:

1. Capital repatriation: Japan has established a substantial overseas asset position;

2. Currency hedging: Japan's overseas investment positions are under-hedge;

3. Carry trade unwinding: As the yen appreciates and yields rise, the profit margins of carry trades narrow, leading to their unwinding.

Among them, the unwinding of carry trades is the most direct factor driving the short-term strength of the yen and the weakness of Japanese/global stock markets. As the yen appreciates, the exchange rate losses may exceed the interest differential gains, prompting more carry traders to exit, which in turn further pushes up the yen.

However, the actual interest rate differential between the US dollar and the yen remains at an extremely wide level, and carry trades still have strong appeal. In addition, the yen remains the best choice for financing currency among G10 currencies, with relatively higher interest rates in other countries.

It is also worth mentioning that the Japanese Government Pension Investment Fund (GPIF) may bring support to the Japanese stock market by increasing its domestic asset allocation ratio. In 2020, GPIF increased its target allocation for foreign assets from 40% to 50%, which may be adjusted at the next review. Considering that the GPIF's size exceeds 1.5 trillion US dollars, a 10% adjustment would mean a buying demand as high as 22.5 trillion yen.