After a solid eight-day winning streak that broke through the 3000 point mark, the A-share market barely paused for a single day of consolidation before eagerly launching another assault to reclaim the 3000 point threshold and set a new phase high. What does this call for? This is a classic short squeeze scenario!

Following the minor stock disaster in January, almost all snowballing and quantitative products were wiped out, with the margin balance alone decreasing by 200 billion yuan. A multitude of retail investors and institutions were forced to liquidate their positions at a loss, leading to a complete clearing of the chip structure and a lightening of the load for the market. Subsequently, the bottom was scooped up by the national team and foreign capital. According to UBS calculations, the national team's net purchase of A-shares exceeded 410 billion yuan, effectively locking in their positions. Meanwhile, foreign capital continues to flow in at an accelerated pace. Spectators on the sidelines are now driven by the fear of missing out, rushing to board the train at the sight of any pullback. The second offensive following a pullback will further reinforce this consensus of adding positions out of the fear of missing out. Contrary to the reasons for the decline in January, now the rise itself becomes the reason for the rise.

Let's briefly analyze the current chip structure and then look at today's significant positive news, starting with domestic computing power, which is the main driver behind A-shares' major counteroffensive today.

In yesterday's closing review, we pointed out that, in addition to industrial mother machines, Huawei's Ascend and the Zhongke system's domestic computing power are also very strong, mainly for two reasons: NVIDIA has identified Huawei's calculations as the "biggest competitor," and Huawei's Ascend server orders are surging, with supply not meeting demand, and prices have already started to rise.

Advertisement

Today, there are several significant pieces of news regarding domestic computing power, which I will briefly list for you:

Domestic clients, considering cost-effectiveness and supply chain security, are expected to shift more demand towards domestic AI chips in the future. According to the Observer Network, Alibaba and Tencent have indicated to NVIDIA that the number of chips they will order this year will be far below the original plan, and they are transferring some advanced semiconductor orders to domestic companies like Huawei.

Rumors are circulating that computing power subsidies will be issued, and state-owned enterprises will use Huawei and Sugon servers. This is unconfirmed, but stimulated by the news, Sugon Electronics saw a straight-line surge to the daily limit and led the CPO, server, and liquid cooling, and other AI computing power-related sectors.

The United States, the United Kingdom, and ten other countries issued a joint statement supporting 6G principles. The countries participating in this joint statement include the governments of the United States, Australia, Canada, the Czech Republic, Finland, France, Japan, South Korea, Sweden, and the United Kingdom. The 6G competition has begun, leading to a significant rise in 6G-related sectors.ZTE Corporation launched the AiCube training and inference integrated machine at MWC24 Barcelona, integrating computing, storage, networking equipment, and AI platform software, supporting mainstream AI frameworks, aiming to provide operators and industry users with an Ai-In-One one-stop intelligent computing solution, ZTE's shares hit the daily limit at noon.

State-owned Assets Supervision and Administration Commission: Accelerate the empowerment of new technologies such as artificial intelligence to create a batch of competitive platforms and enterprises.

In addition to the benefits of AI and communications, there are also some significant benefits:

Last week was the first trading week of the Dragon Year in the A-share market, with no new shares listed. This week is the second trading week of the Dragon Year, and it is expected that there will be neither new share applications nor new shares listed, which is the first time since the China Securities Regulatory Commission proposed "temporarily tightening the IPO pace" on August 27, 2023, that an entire trading week has seen no new shares listed or applied for. Although the IPO is just a rumor, in essence, the IPO has almost been frozen.

In response to the requirements of the regulatory authorities, various securities firms have actively taken measures to deal with violations of short-selling transactions. Securities firms' two-way financing business personnel said that short-selling disguised as T+0 refers to investors buying and selling a certain stock on the same day in their credit accounts, and prohibiting this practice can better reflect fairness. In addition, investors' practices of cashing out through two-way financing or circumventing the standard have also been banned, and some securities firms have issued relevant notices in January this year. In the recent period, the scale of short-selling in the market has decreased significantly.

After looking at today's benefits, let's look at the market performance. As of the close, the Shanghai Composite Index rose by 1.29%, recovering the 3000-point mark, and the ChiNext Index rose by 2.41%. After the A-shares closed, Hong Kong stocks continued to strengthen, with the Hang Seng Index rising by 0.94% and the Hang Seng Technology Index rising by 3.24%. The turnover of the two markets increased to 0.99 trillion, with more than 5,000 stocks in the two markets rising.

Looking at the industry, the computer, communication, electronics, media, automotive, and other industries led the increase.

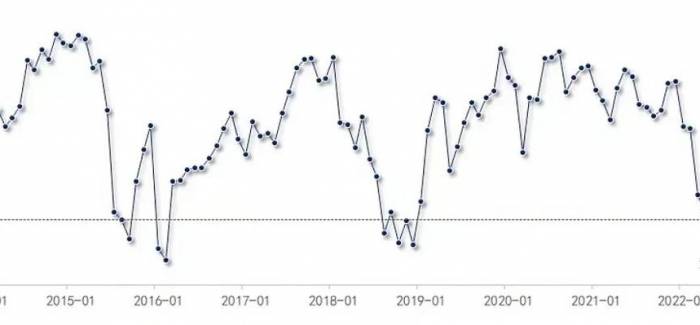

We have always emphasized that whether A-shares can go from rebound to reversal depends on the increase in funds, and we believe that the increase in funds mainly comes from the addition of insurance funds, foreign funds, and financing.Let's start with foreign capital. Since late January, foreign capital has been continuously buying A-shares. At that time, there were funds from the national team disguised as private investors, but after the holiday, these disguised funds have basically disappeared. The purchases now are all from long-term foreign investors who are configuring their portfolios, indicating that foreign capital has shifted its stance. In the hearts of most foreign institutions, geopolitical issues, Sino-US relations, or policies are merely excuses for a bearish outlook. If China's stock market can create a sustained profit effect, then a considerable amount of foreign capital will return.

Next, let's look at margin financing. In January, the bursting of margin calls reduced the funds by 200 billion, and then from February 8th to the present, margin financing has continued to increase by nearly 50 billion. Even if it returns to the high point of January, there is still a gap of more than 100 billion.

Lastly, regarding private equity, according to calculations by Cinda Securities, during the sharp market decline in January, private equity quickly reduced its positions to a new low since 2014, indicating that there is also a significant room for private equity to increase its positions.

Overall, there is still a considerable amount of space for incremental funds. Yesterday, in our closing review, we noted that the oversold rebound in A-shares has almost been completed. To further transition from a rebound to a reversal, it would require either economic policies that exceed expectations or industrial policies that exceed expectations. The former corresponds to the recovery line and cyclical stocks, while the latter corresponds to growth-themed stocks. Today, the AI sector, which is driven by industrial policy, has risen. If the economic stimulus policies during the Two Sessions exceed expectations, then the heavyweight stocks will also start to move, and that would be the rhythm of a bull market. Of course, if the policies do not exceed expectations, one should be cautious about cashing out before important meetings.

Risk warning:

The stock market involves risks, and investment should be approached with caution. This article does not constitute investment advice, and readers should think independently.